Brand Overview

Brand:

Horlicks

Parent Company:

Horlicks Brothers, UK

Core Categories:

Beverages

Taglines Over the Years:

- Taller, Stronger, Sharper

- A glass full of strength

- Tum badhte jao, Horlicks badhta jaaye

Market Context at Launch

Pre-Independence (1900s–1947)

- Originally developed in the UK as a nourishing drink for soldiers and invalids.

- Introduced in India through British army canteens and medical institutions.

- Gained early credibility as a recovery drink—particularly post-surgery or illness.

- Grew popular among Indian middle-class families, seen as a symbol of care and nutrition for children.

- One of the first branded Western "health drinks" in India.

Marketing Mix (4Ps)

Product Strategy

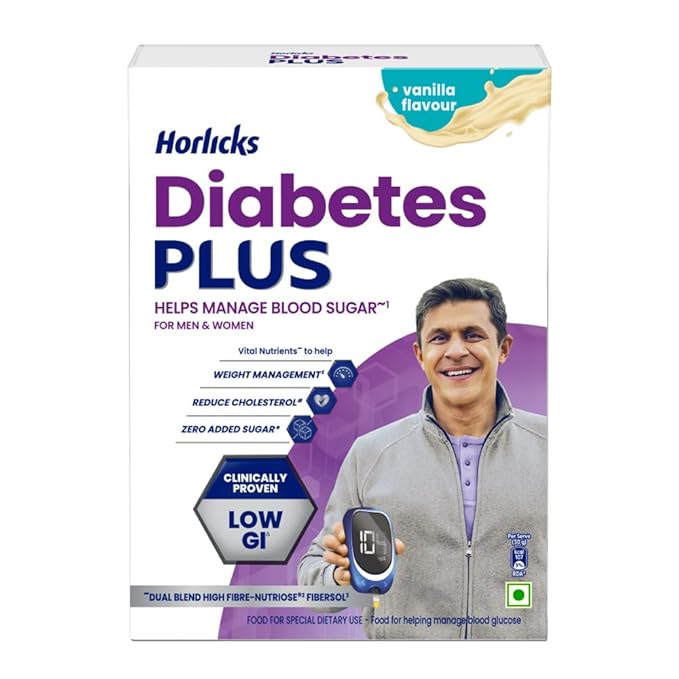

Core Product

- A malted milk drink mix, consumed with hot milk.

- Fortified with vitamins, minerals, protein, and calcium.

- Developed over time to meet changing nutritional standards.

- Junior Horlicks – For toddlers (ages 2–6)

- Women's Horlicks – For bone health and iron support

- Horlicks Growth+ – For children with growth concerns

- Mother's Horlicks – For pregnant/lactating women

- Chocolate, Elaichi, Kesar Badam, Vanilla flavors

Pricing Strategy

- Premium pricing due to its health positioning and brand trust.

- SKUs for all income levels: from ₹10 sachets to ₹500+ large jars.

- Priced above Bournvita and Complan, but justified by scientific positioning and doctor recommendations.

Promotion Strategy

Early Branding

- Positioned as essential for growing children and as a family health drink.

- Leveraged doctor endorsements in advertisements.

- “Taller, Stronger, Sharper” (1990s–2000s): Focused on children's physical and cognitive growth.

- Doctor-Led Advertising: Commercials showing growth charts, clinical trials, etc., to build credibility.

- Mother-centric storytelling: Most campaigns emotionally showed mothers' care and sacrifices, with Horlicks as their nutritional partner.

- Videos showing child aspirations (sports, academics), with Horlicks enabling that journey.

- Campaigns on mental strength, immunity, and digital well-being in the 2020s.

Distribution Strategy

- Wide distribution via pharmacies, grocers, supermarkets, and e-commerce.

- Deep penetration in South India, particularly Tamil Nadu, Andhra Pradesh, and Kerala, where Horlicks became a cultural staple.

- Used sampling in schools and clinics and doctor engagement programs.

Competitive Landscape

Main Competitors

- Bournvita (Mondelez) – stronger chocolate and sports-centric appeal

- Complan (Zydus Cadila) – earlier “Height first” messaging

- PediaSure (Abbott) – positioned for children with growth delays

- Boost – more performance- and stamina-focused (also owned by HUL)

Horlicks' Advantage

- Doctor trust and long-standing presence

- Complete family range (kids, women, pregnant mothers)

- Regional loyalty, especially in Southern India

- Extensive R&D and clinical claim backing from its GSK heritage

Consumer Perception & Emotional Connect

- Seen as “the caring mother's choice” for decades.

- Built strong trust with:

- Parents of school-going children

- Women during pregnancy

- Households recovering from illness or undernourishment

- Perceived as scientific, safe, and legacy-driven—unlike newer HFD brands with more aggressive claims.

Challenges & Strategic Responses

Challenges

- Category stagnation in urban India—HFDs perceived as sugary or outdated.

- Rising competition from nutrition bars, protein shakes, and functional drinks.

- Shifting consumer focus to "natural" or "organic" products.

- Regulatory tightening on nutritional claims and sugar content.

- Reformulation: Lower sugar, added probiotics, micronutrients.

- New formats: Sachets, ready-to-drink bottles, protein mixes.

- Focused digital engagement: Parenting blogs, expert advice portals, HUL Health Hub.

- Premiumization: Launch of Horlicks Protein+, Growth+, and age-specific variants.

Transition to Hindustan Unilever (2020–Present)

- In 2020, HUL acquired Horlicks and Boost from GSK Consumer Healthcare.

- Brought in Unilever's marketing scale, digital prowess, and R&D.

- Relaunched Horlicks in new packaging, rebranded several variants.

- Integrated into HUL's Foods and Refreshments Division.

Current Position (as of 2025)

- Estimated India market share in HFDs: ~45% (category leader)

- Approximate revenue: ₹3,000–₹3,500 crore annually in India

- Present in 20+ countries via export and NRIs

- Leading brand in Southern India, with significant growth in North-East and East India

Key Learnings

- Medical trust and scientific backing can sustain a brand across generations.

- Mother-centric emotional storytelling creates long-term brand equity.

- Regional focus (South India) can be a brand's lifeline even when urban trends shift.

- Brand evolution with lifestyle changes (e.g., protein needs, low sugar, kids' growth) keeps it relevant.

- M&A (from GSK to HUL) can reinvigorate legacy brands with scale and innovation.

Summary

Horlicks is not just a malted drink—it is a cultural icon of care and nourishment in Indian homes. From the British Raj to modern digital India, it has managed to stay relevant by staying true to its core promise of health and trust while smartly adapting to modern concerns like growth, immunity, and wellness.